Enquiry Form

Notification No. 43/2020/F. No. 370142/11/2020-TPL]

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICATION New Delhi, the 3rd July, 2020

INCOME-TAX

G.S.R. 429(E).— In exercise of the powers conferred by sections 194A, 194J, 194K, 194LBA, 194N, 194-O, 197A and 200 read with section 295 of the Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes, hereby, makes the following rules further to amend the Income-tax Rules, 1962, namely:-

1. Short title and commencement.–– (1) These rules may be called the Income-tax (16th Amendment) Rules, 2020. (2) Save as otherwise provided in these rules, they shall come into force from the date of their publication in the Official Gazette.

2. In the Income-tax Rules, 1962 (hereinafter referred to as the principal rules), in rule 31A, in sub-rule (4), —

(a) in clause (viii), after the words “not deducted”, the words “or deducted at lower rate” shall be inserted;

(b) for clause (ix) the following shall be substituted from the 1st day of July, 2020, namely:-

“(ix) furnish particulars of amount paid or credited on which tax was not deducted or deducted at lower rate in view of the notification issued under second proviso to section 194N or in view of the exemption provided in third proviso to section 194N or in view of the notification issued under fourth proviso to section 194N”;

(c) after clause (ix), the following clauses shall be inserted, namely:–

“(x) furnish particulars of amount paid or credited on which tax was not deducted or deducted at lower rate in view of the notification issued under sub-section (5) of section 194A.

(xi) furnish particulars of amount paid or credited on which tax was not deducted under sub-section (2A) of section 194LBA.

(xii) furnish particulars of amount paid or credited on which tax was not deducted in view of clause (a) or clause (b) of sub-section (1D) of section 197A.

(xiii) furnish particulars of amount paid or credited on which tax was not deducted in view of the exemption provided to persons referred to in Board Circular No. 3 of 2002 dated 28th June 2002 or Board Circular No. 11 of 2002 dated 22nd November 2002 or Board Circular No. 18 of 2017 dated 29th May 2017.”

3. In the principal rules, in Appendix II, (I) in form 26Q – (a) for the brackets, words, figures and letters “[See sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194- I, 194J, 194LA, 194LBA, 194LBB, 194LBC, 194N and rule 31A]” the following brackets, words, figures and letters

“[See sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194- I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194N, 194-O, 197A and rule 31A]” shall be substituted;

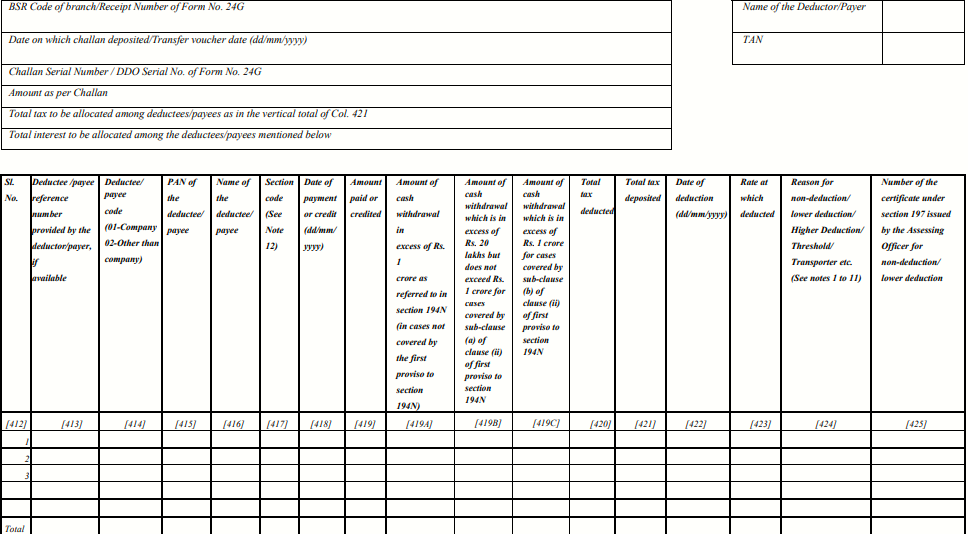

“[ANNEXURE: DEDUCTEE/PAYEE WISE BREAK UP OF TDS

Verification

I, ………………………………………………………………… , hereby certify that all the particulars furnished above are correct and complete.

Place: ………………….. …………………………………………..

Signature of the person responsible for deducting tax at source

Date: ………………….. ………….………………………………..

Name and designation of the person responsible for deducting tax at source

Notes:

1. Write “A” if “lower deduction” or “no deduction” is on account of a certificate under section 197.

2. Write “B” if no deduction is on account of declaration under section 197A other than the cases mentioned in sub-section (1F) of section 197A.

3. Write “C” if deduction is on higher rate on account of non-furnishing of PAN by the deductee/payee.

4. Write “D” if no deduction or lower deduction is on account of payment made to a person or class of person on accont of notification issued under sub-section (5) of

section 194A.

5. Write “E” if no deduction is on account of payment being made to a person referred to in Board Circular no. 3 of 2002 dated 28

th June, 2002 or Board Circular no.

11 of 2002 dated 22nd November, 2002 or Board Circular no. 18 of 2017 dated 28th May, 2017.

6. Write “Y” if no deduction is on account of payment below threshold limit specified in the Income-tax Act, 1961.

7. Write “T” if no deduction is on account of deductee/payee being transporter. PAN of deductee/payee is mandatory [section 194C (6)].

8. Write “Z” if no deduction or lower deduction is on account of payment being notified under section 197A (1F).

9. Write “M” if no deduction or lower deduction is on account of notification issued under second proviso to section 194N.*

10. Write “N” if no deduction or lower deduction is on account of payment made to a person referred to in the third proviso to section 194N or on account of

notification issued under the fourth proviso to section 194N.*

11. Write “O” if no deduction is as per the provisions of sub-section (2A) of section 194LBA.

12. List of section codes is as under:

| Section | Nature of Payment | Section Code |

|---|---|---|

| 192A | Payment of accumulated balance due to an employee | 192A |

| 193 | Interest on securities | 193 |

| 194 | dividend | 194 |

| 194A | Interest other than interest on securities | 94A |

| 194B | Winnings from lotteries and crossword puzzles | 94B |

| 194BB | Winnings from horse race | 4BB |

| 194C | Payment of contractors and sub-contractors | 94C |

| 194D | Insurance Commission | 94D |

| 194DA | Payment in respect of life insurance policy | 4DA |

| 194EE | Payments in respect of deposits under National Savings Schemes | 4EE |

| 194F | Payments on account of repurchase of Units by Mutual Funds or UTIs | 94F |

| 194G | Commission, prize etc., on sale of lottery tickets | 94G |

| 194H | Commission or Brokerage | 94H |

| 194-I(a) | Rent | 4-IA |

| 194-I (b) | Rent | 4-IB |

| 194J(a) | Fees for Technical Services(not being professional services), royalty for sale, distribution or exhibition of cinematographic films and call centre (@2%) | 94J-A |

| 194J (b) | Fee for professional service or royalty etc. (@10%) | 94J-B |

| 194K | Income in respects of units. | 94K |

| 194LA | Payment of Compensation on acquisition of certain immovable property | 4LA |

| 194LBA(a) | Certain income in the form of interest from units of a business trust to a residential unit holder | 4BA1 |

| 194LBA(b) | Certain income in the form of dividend from units of a business trust to a resident unit holder | 4BA2 |

| 194LB | Income in respect of units of investment fund | LBB |

| 194LBC | Income in respect of investment in securitization trust | LBC |

| 194N | Payment of certain amounts in cash | 94N |

| 194N First proviso* | Payment of certain amounts in cash to non-filer | 94N-F |

| #194-O | Payment of certain sums by e-commerce operator to e-commerce participant | 94O” |

(II) in form 27Q —

(a) for the brackets, words, figures and letters

“[See sections 194E, 194LB, [194LBA, 194LBB, 194LBC], 194LC, 195, 196A, 196B, 196C, 196D, and rule 31A]”

the brackets, words, figures and letters

“[See section 194E, 194LB, [194LBA, 194LBB, 194LBC], 194LC, 194N, 195, 196A, 196B, 196C, 196D, 197A and rule 31A]” shall be substituted;

(b) for the “Annexure” the following “Annexure” shall be substituted, namely:–

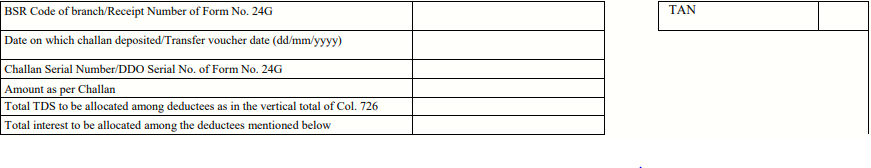

“[ANNEXURE: DEDUCTEE WISE BREAK UP OF TDS]

(Please use separate Annexure for each line item in Table at Sl. No. 04 of main Form 27Q)

Details of amount paid/credited during the quarter ended (dd/mm/yyyy) and of tax deducted at source

Verification

I, …………………………………………………………………………………………………………….., hereby certify that all the particulars furnished above are correct and complete.

………………………………………………………………………………………. ……………………………

Place: ………………………… Signature of the person responsible for deducting tax at source

Date: ………………………………………………………………………. .. ……

Name and designation of the person responsible for deducting tax at source

Notes:

1. Write “A” if “lower deduction” or “no deduction” is on account of a certificate under section 197.

2. Write “C” if grossing up has been done.

3. Write “D” if deduction is on higher rate on account of non-furnishing of [Permanent Account Number or Aadhaar Number] by the deductee.

4. Write “O” if no deduction is in view of sub-section (2A) of section 194LBA.

5. Write “M” if no deduction or lower deduction is on account of notification issued under second provison to section 194N.*

6. Write “N” if no deduction or lower deduction is on account of payment made to a person referred to in the third proviso to section 194N or on account of notification issued under the fourth proviso to section 194N.*

7. Write “G” if no deduction is in view of clause (a) or clause (b) of sub-section (1D) of section 197A.

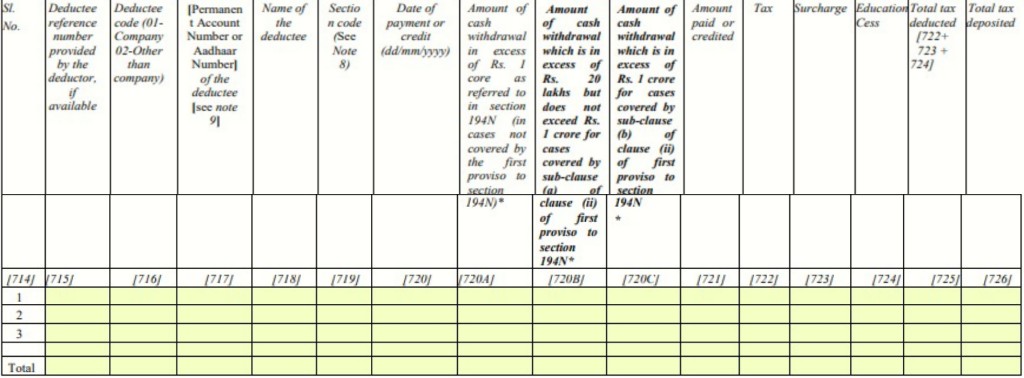

8. List of section codes is as under:

9. In case of deductees covered under rule 37BC, Permanent Account Number or Aadhaar Number NOT AVAILABLE” should be mentioned.”

*in relation to section 194N, the changes shall come into effect from 1st July, 2020.

#in relation to section 194-O, the changes shall come into effect from 1st October, 2020.

[Notification No. 43/2020/F. No. 370142/11/2020-TPL]

ANKIT JAIN, Under Secy. (Tax Policy and Legislation Division)

Note: The principal rules were published in the Gazette of India, Extraordinary, Part-II, Section 3, Sub-section (ii) vide number S.O. 969 (E), dated the 26th March, 1962 and were last amended vide notification number G.S.R. 423 (E), dated 30.06.2